YES, Fannie Mae Requires Baton Rouge Home Appraisers Review Purchase Agreement! SEE “BUYERS BIDDING UP HOME PRICES NOTE” below.

YES, Fannie Mae Requires Baton Rouge Home Appraisers Review Purchase Agreement! SEE “BUYERS BIDDING UP HOME PRICES NOTE” below.

A conversation on Facebook about this post 5 things NOT to say to an appraiser if you don’t want to be accused of influencing them by Tom Horn, SRA, Birmingham AL Appraisal Blog, led to the question if the Home Appraiser should have a copy of the purchase agreement.

I personally am not of the mindset of documenting or turning in Agents that communicate with me during the Home Purchase process. Local Agents have been well educated by their Brokers and understand the professional protocol of Dodd-Frank inacted in 2010.

Local Real Estate Agent Darrell Davis asked, “On new construction can the listing agent offer-up 1) lot prices in the subdivision and note if the subject is on a premium lot & 2) note add-on’s/trade-ups to the subject. Also, can/should the appraiser have the purchase agreement”

My Reply Is Below:

Hi Darrell, personally when I’m setting up the appraisal inspection, as a professional courtesy, I tell the Agent that this is their opportunity to send me the comps used to market the property. I’ve always believed there are at least 3 professionals involved in a home purchase…Listing Agent, Selling Agent and Appraiser. There are many Agents that “Farm” markets and know them better than Appraisers do. Agents may know more about the school system or district for the subject property. I’m wide open to the data the Agent has to offer AT THE BEGINNING of the appraisal appointment process. After the Appraisal inspection, communication ends, period. The problem comes in when the Agent simply says, “Hey Look, let me know if it’s coming in below P.A. and I’ll see if I can find better comps for you!” and that’s what Tom Horn is saying. THOSE DAYS ARE OVER and have been over since Dodd-Frank was inacted in 2010.

Hi Darrell, personally when I’m setting up the appraisal inspection, as a professional courtesy, I tell the Agent that this is their opportunity to send me the comps used to market the property. I’ve always believed there are at least 3 professionals involved in a home purchase…Listing Agent, Selling Agent and Appraiser. There are many Agents that “Farm” markets and know them better than Appraisers do. Agents may know more about the school system or district for the subject property. I’m wide open to the data the Agent has to offer AT THE BEGINNING of the appraisal appointment process. After the Appraisal inspection, communication ends, period. The problem comes in when the Agent simply says, “Hey Look, let me know if it’s coming in below P.A. and I’ll see if I can find better comps for you!” and that’s what Tom Horn is saying. THOSE DAYS ARE OVER and have been over since Dodd-Frank was inacted in 2010.

Also, when the purchase agreement is received is not the time to go digging for comps because the Agent simply listed the home at what the seller thought it was worth. The Agent should have a list of comps in their own workfile from when the home was originally listed. SETTING THE LISTING PRICE AT WHAT THE SELLER WANTS VERSUS WHAT THE MARKET WILL OBVIOUSLY SUPPORT ONLY LEADS TO HOMES THAT DON’T APPRAISE!

Yes, about the premium lot and if you’d filled out the GBRMLS Listing properly, the fact that’s it’s a premium should be made obvious. Honestly, the biggest problems Appraisers have with GBR Agents Lot Listings are that they are not always filled out entirely, they rarely ever state what % of lot is cleared or wooded, lot dimensions aren’t always stated and there’s little in terms of verbiage to help Appraisers explain the benefits of the lot.

Should the Appraiser have the purchase agreement?

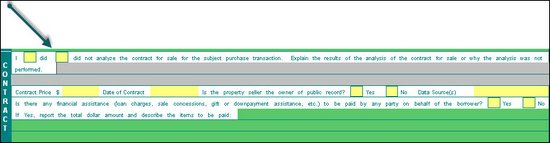

Absolutely they should! What’s the definition of Market Value? What a willing buyer and seller come to terms to. The Appraiser needs to know how the market or buyers reacted to the subject on the market. And, FNMA, FHA, FMHA (Rural Development) and VA require the Appraisers to have a copy of P.A. and report the details of the P.A. on the Fannie Mae Form 1004. I quote from the 1004: “I Did or Did Not analyze the contract for sale for the subject purchase transaction. Explain the results of the analysis of the contract for sale or why the analysis was not performed.” In trainging for the FNMA 1004 form, we were told to state the Agent’s name and contact info that forbid the Appraiser from reviewing the P.A. Fannie Mae is serious about Appraisers reviewing P.A.’s.

Also on P.A. reviews, was the home listing in duress or distress? Is there a substantial amount of personal property involved that would artificially raise the price?

SELLER PAID CONCESSIONS ARE A BIG DEAL!

P.A.’s tell the Appraisers how much in concessions. When sellers are having to pay buyers to buy their homes, that’s not a good situation and FNMA and FHA, after taking back so many homes sold without skin in the game, realizes this. Under $5,000 might be normal, but $6,000 to $20,000 is excessive and artifically raise prices in a market. FNMA Guidelines tell the Appraisers to DEDUCT excessive seller paid concessions, period. That’s why FHA did away with these Ameridream type programs because they took a bath on such buyer assistance. AND, APPRAISERS ARE NOT OBLIGATED TO APPRAISE HOMES $5,000 TO $15,000 HIGHER JUST BECAUSE THE AGENT/BUYER/SELLER ARE TRYING TO ROLL IN $5K TO $15k INTO THE DEAL FOR CONCESSIONS, THAT BEING $5K TO $15K ABOVE THE CURRENT LISTING PRICE. If the Agent believed the home was worth $295,000, home is listed for $295,000 and the P.A. is for $310,000 based on $15K in closing cost, then the Appraiser has absolutely no obligation to appraise at $310,000! I’ve seen some Agents that try to work excessive seller paid concessions into every deal they can and I cringe when I receive these appraisal orders.

BUYERS BIDDING UP HOME PRICES NOTE: In markets where the market is bidding up home purchase prices with Purchase Agreements, the Appraiser needs to know about this. If I’m appraising a home listed at $295,000, there’s 1 purchase agreement at $315,000 after 3 days on the market with no seller paid concessions and 4 backup offers with no seller paid concessions, then this is information I as an Appraiser need to know about. FIVE (5) purchase agreements on 1 home in 3 days would certainly open my eyes to market demand. AND, note that in Baton Rouge, I’ve never in 19 years seen such an occurence with the exception of the aftermath of Hurricane Katrina when New Orleans residents were paying top dollar for local housing.