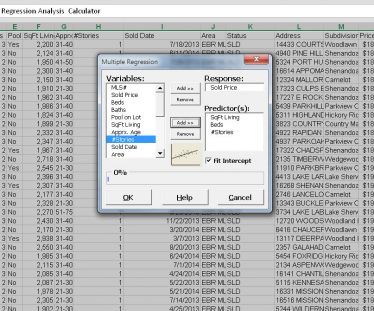

How Do Baton Rouge Appraisers Use Regression Analysis To Support Adjustments?

This article covers regression analysis in real estate appraising. Sourced through Scoop.it from: dwslaterco.blogspot.com What is regression analysis and how do Appraisers use it to help better view their market and support adjustments? – Best Detailed visual explanation I’ve read about regression by Texas appraisal group. DW Slater blog offers many helpful explanations of the […]

Pre Contract Price Home Appraisals Baton Rouge

http://www.gbrprelistingappraisals.com – Pre Contract Price Home Appraisals in Baton Rouge, Denham Springs, Zachary Louisiana, Walker Louisiana, City of Central Baton Rouge, Praireville Louisiana, Gonzales Louisiana, Geismar Louisiana, Baker Louisiana. HELPING BATON ROUGEONS UNDERSTAND HOW THE BATON ROUGE HOUSING MARKET WORKS By Bill Cobb, Greater Baton Rouge’s Home Appraiser 225.293.1500 Selling Your Greater Baton Rouge Home […]

Are you a cross your fingers type of Baton Rouge REALTOR when it comes to appraisals ?

Do you cross your fingers in hopes that the appraisal doesn’t come in low? My Appraiser Friend and Collegue, Tom Horn SRA in Birmingham AL offers on supporting your listing price. If you’re a listing agent, and the title of this blog describes the way you prepare for real estate appraisals on your listings, then […]

Baton Rouge Pre-Purchase Cash Sale Appraisals Explained Video

Pre-Purchase Home Appraisals For Cash Sale In Baton Rouge Explained This involves the homebuyer paying cash and obtaining a pre purchase home appraisal, pre-purchase home appraisal or cash sale home appraisal to determine if they’re paying a fair price and if the physical information presented by REALTOR is correct or not. Physical information can be […]

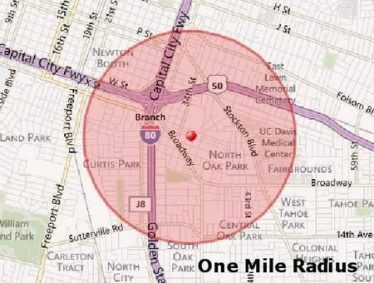

Does one-mile radius of comps in appraisals still apply

Does one-mile radius of comps in appraisals still apply in 2016? Sourced through Scoop.it from: activerain.com Does one-mile radius of comps in appraisals still apply in 2016? ANSWER: I would strongly recommend watching Fannie Mae’s CU video on comp selection. I’ve attempted to provide actual Fannie Mae references to help answer this concern. http://activerain.com/blogsview/4811305/does-one-mile-radius-of-comps-in-appraisals-still-apply-in-2016-

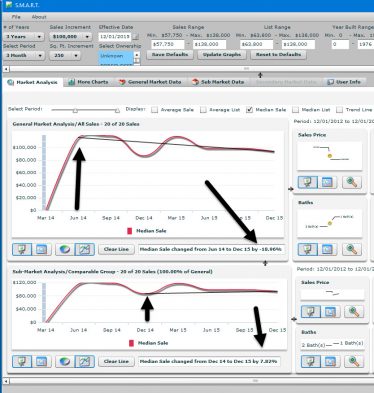

Seeing the forest and the trees in real estate, look at more than 12 months of data

Seeing the forest and the trees in real estate Sourced through Scoop.it from: sacramentoappraisalblog.com Seeing the forest and the trees in real estate by Ryan Lundquist. Look at more than 12 months of data My comment: Great Point, Ryan! Yesterday, I was completing a SMART Appraiser history graph of median sales price showing +7.8% gain over […]