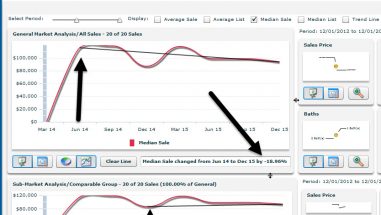

Fannie Mae CU or Collateral Underwriter can be frustrating to Home Appraisers when their computer models try to second guess Appraiser’s judgment.

Now computer models tell Appraisers the comps they should use instead of Appraiser Judgment

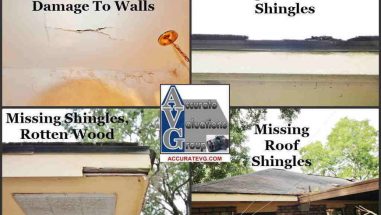

For example, this past week, I performed a foreclosure purchase on a home obviously needing some repairs and on the market for a much longer than average 275 days in two (2) REO listings. It sold between $25,000 to $30,000 below market…for a reason. After submitting the report, I received the following revision request: “The appraiser-provided comparables are materially different than the model selected comparables.”

Sourced through Scoop.it from: activerain.com

Baton Rouge Appraiser Frustration Computers Questioning My Judgment

Fannie Mae CU or Collateral Underwriter can be frustrating to Home Appraisers when their computer models try to second guess Appraiser’s judgment.

Now computer models tell Appraisers the comps they should use instead of Appraiser Judgment

For example, this past week, I performed a foreclosure purchase on a home obviously needing some repairs and on the market for a much longer than average 275 days in two (2) REO listings. It sold between $25,000 to $30,000 below market…for a reason. After submitting the report, I received the following revision request: “The appraiser-provided comparables are materially different than the model selected comparables.”